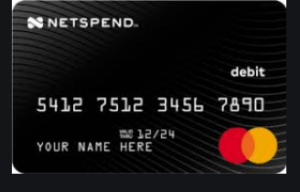

NetSpend Prepaid card

Do you fear credit card fraud and identity theft? Have you ever been a victim? Do you prefer to use prepaid cards and be sure you are spending your own money? Credit card money is a debt that you will surely pay. If you answered yes to the questions above, why not try the NetSpend Prepaid card? It is one of the most widely used prepaid cards. With over 7 million members who use the card to make online purchases, receive direct deposits from employers and relatives, and pay bills, you cannot ask for a better-prepaid card. Having this cad is almost the same as having a checking account.

Interestingly, you easily qualify for the card since it does not require a credit check. To get a Netspend Prepaid Card, go to www.gonetspend.com. Complete the short online guaranteed approval form by supplying you: full name, residential address, email address, and choosing the type of NetSpend Prepaid debit card you want. Each NetSpend card has a MasterCard logo and this allows you to use it anywhere MasterCard is accepted.

Features and Benefits of Netspend Prepaid Card

- Firstly, there are over 130,000 reload locations in case cardholders want to add money to their cards.

- Secondly, you do not get a credit check while or before applying for the card.

- Thirdly, there is no activation key for the Netspend Prepaid Card.

- The card is safer for use since you do not need to fear identity theft or credit card fraud. If you want to, just deposit what you want to spend.

- Cardholders get paid faster through direct deposits from their employers. Direct deposits on prepaid cards are 2 days faster than paper checks.

- There are no fees such as annual, balance transfer, APRs, and lots more.

- Also, there is no debt that the cardholder has to pay back monthly.

- Since there is no debt, cardholders spend only what they have in their accounts.

- Finally, it is simple and convenient to use. Also, there is no anxiety on the part of the cardholder since there is no debt to pay back at the end of the month.

On the other hand, it is important to know that this card does not affect your credit. It cannot improve or worsen it since there is no credit check and no reporting to the credit bureaus.

from WordPress https://ift.tt/34mDoSA

No comments:

Post a Comment