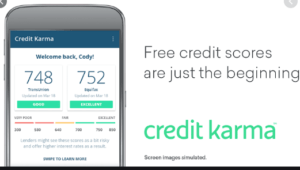

Credit Karma workswithEquifax and TransUnion which happens to be two of the three major credit bureaus offer credit users free credit scores and free credit reports.

Credit Karma offers free credit scores and reports and makes money. This is gotten by using the information in your credit profile. Which does proffer help that makes credit users save money. If you use the suggested help in applying for a product, Credit Karma may get a commission from the bank or lender.

What Kind of Free Credit Scores Does Credit Karma Offer?

Credit Karma offers credit scores and reports from Equifax and TransUnion. They both use the VantageScore 3.0 scoring models. VantageScore was created alongside with all three major credit bureaus. And it’s a 3.0 version that is widely used in lending decisions.

Additionally, Credit Karma, in line with smaller companies like Credit Sesame and MyFICO, advertises easy-to-read credit reports. They also personalize score insights and free credit monitoring. This helps members spot potential identity theft, among other options. Even though the service is free to users. Credit Karma makes money when those users sign up for loans and credit cards displayed on their website.

Does Credit Karma Offer Free FICO® Credit Scores?

This does not offer FICO® credit scores, which are calculated differently from VantageScore credit scores. The three major credit bureaus created the VantageScore model, while FICO on the other hand is a separate company with its own scoring models.

Although the VantageScore and FICO models differ in different ways. That does not mean that one is better or more accurate than the other. Lenders may choose what scoring models to make their judgment when evaluating an application. Other considerations can come into play too.

How Often Should You Check Your Free Credit Scores?

Checking your free credit scores on Credit Karma is not a one-time thing. This is because your scores may be often updated as your credit history changes. Thus checking them often can help you stay updated on changes in your credit profile.

Now checking your free credit scores does not hurt your credit. So you can check your credit score as often as you like. Checking your credit score and seeing that it steadily grows is a way of helping you on your credit-building journey. Also when you are ready to submit a credit application. Having a better idea of your overall credit health before you apply can help you know what your fate is.

Credit Karma checks your FICO score on your behalf thus conducts a soft inquiry. Soft inquiries are quite different from hard inquiries because they leave your credit scores unaffected. Multiple hard inquiries on the other hand done within a short period of time can take off as much as five points. This is done per inquiry and can stay on the record for two years.

Credit bureaus are known to deduct points. If the person has a short credit history or only a few accounts. Credit bureaus interpret multiple hard inquiries as showing that the person may be a high-risk borrower. The bureaus are curious that the person may be desperate for credit. And maybe unable to get the credit from other creditors. According to MyFICO, people with multiple hard inquires are eight times more likely to declare bankruptcy . Other people with no hard inquires on their reports may not be able to declare.

Other Free Tools Offered by Credit Karma

Apart from checking your credit score on Credit Karma, there are also other tools that you can find beneficial:

Free Credit Reports

On Credit Karma, you can check your free credit reports from Equifax and TransUnion. And you can also check your free credit reports as much as you like.

Free Credit Monitoring

Credit Karma offers you a free credit monitoring service. This can alert you to important changes to your Equifax and TransUnion credit reports. Along with checking your credit scores, this feature sends you an alert to enable you to spot any suspicious activity.

Mobile App

You’re offered a mobile app. This enables you to check your credit scores on the go. The app features tools that range from the new Relief Roadmap to opt-in push notifications. Which can help alert you to potential changes on your Equifax or TransUnion credit reports

from WordPress https://ift.tt/2IhgjbF

No comments:

Post a Comment