Currently, you can use your on-time utility bill payments in improving your credit score. This is as opposed to previous practices where utility bills could only hurt your credit score if you defaulted on your payments. Where you defaulted on your payments, your provider could close your account and enlist a collection agency to obtain credit payment which negatively affects your credit report for seven years.

Are Utility Bills Reported to Credit Bureaus?

Right from time, utility bills have historically been left out of consumer credit reports entirely. This because they are not considered credit accounts. Currently, utility companies do not automatically report your monthly payments to three credit reporting agencies (Experian, Equifax and TransUnion).

How Can Utility Bills Help Your Credit?

Even though utility bills are not typically used to determine your credit score, that does not mean you can ignore them. It is advised that you pay all your bills on time, whether or not your routine payments are reported to the credit bureaus.

However, if you are looking for ways to build credit without taking out loans or opening credit cards, there are a limited number of ways to get your on-time payments reflected on your credit report. But understand that at the end it may not really be worth it.

Many bills like rent and utilities are not routinely reported to credit bureaus like credit card and loan payments. This implies that making on-time utility bills do not help in building credit. However, failing to make these payments can lead to collections actions which may almost certainly damage your credit. Where you fall more than a month or two behind on any bill from cable to electric, the company may send your past-due account to a collections agency. Once this happens, the collections agency can (and usually will) notify the credit reporting bureau. This is not good at all, because having a collections action on your report will significantly lower your credit score and can put a dent in your credit report for up to seven years.

How to Make Your Payment Behavior Count

There are three steps that can help your on-time monthly payments boost your credit score. Here they are:

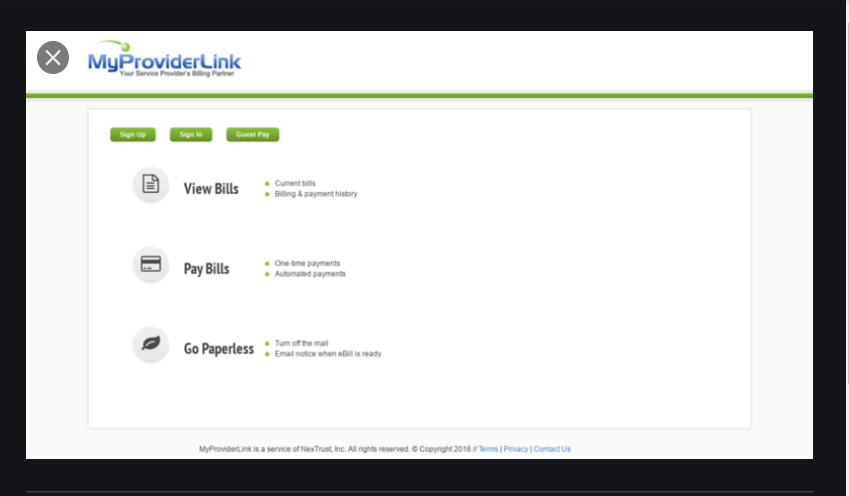

Use SimpleBills

SimpleBills is a service which currently reports utility bills. To Equifax and is making plans to include TransUnion and Experian in the future. This credit-reporting service charges $2.99/month and. Can come in handy for those who want to improve. Their score for building a credit history to qualify for a credit or a loan payment.

However, while your Equifax number may see. An increase through SimpleBills, major score algorithms, like FICO and Vantage. Might not consider this data when calculating your score.

Use a Rent-Reporting Service

Before you can have your monthly rent payments reflect positively. On your credit score, the credit bureaus must. Know that you’re paying your bills on time. They will not accept this information from consumers. However, you can sign up for a rent-reporting service. The service will in turn pass this information to one. Or two of the three major credit bureaus. Now some of these services are free, though most of them charge for the service. With fees ranging up to $100 a year.

Sign Up for Experian Boost

Now you have the opportunity of getting. That credit with Experian Boost. Via this tool, you allow Experian to access your bank account information. In order to identify various utility and telecom payments. Including your cell phone bill.

You’ll have the opportunity of verifying the information. And confirming that you want to add it to your credit report. The entire process will only take about five minutes, and. If you qualify for a boost to your credit score, it happens instantly.

Experian Boost only considers on-time payments. Thus you don’t have to worry about late payments having a negative impact on your credit score.

According to the data from Experian, 10% of people who previously didn’t have enough information in their credit file to have a credit score became scoreable after using the tool. Also, 75% of people with a FICO® Score below 680 saw an improvement in their score after adding utility payment information to their report.

Social Media: Facebook, Twitter, Wikipedia, LinkedIn, Pinterest

from WordPress https://ift.tt/3l8CZJB