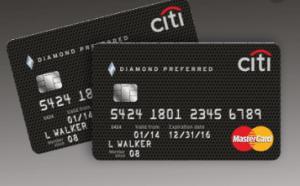

Did you recently get a pre-approval offer mail inviting you to apply for the Citi Diamond Preferred Credit Card? If you really need a card, you can go ahead and apply for the card at www.citi.com/applydiamondpreferred. You can as well fill the acceptance offer that came along with the pre-approval offer and send it to the email address written on the mail you got. This takes about 7 working days to receive a response. However, the online application is very easy and fast as you will get a response about your acceptance immediately after applying for the card.

This card is for individuals with Excellent Credit score and history. You can apply for this card online at www.citi.com/applydiamondpreferred. If you really need the Citi Diamond Preferred Credit Card,

apply for it through the following steps:

- Go to citi.com/applydiamondpreferred.

- Supply the 12 digit Citi Diamond Preferred invitation number on the mail you got.

- Enter your 5 digits zip code.

- Enroll your last name.

- Click on the Submit button.

- Verify your details.

- Click on Proceed to Application.

- Finish the application process.

They usually pre-fill your name and address to help you quicken the application process. However, you will still supply the followings:

- Date of birth.

- Mother’s maiden name.

- Email address.

- The primary source of income.

- Your primary phone number.

- Review the terms and conditions.

- Click on the Submit button.

Once you do all the above, you will instantly get a decision regarding your approval. If you are approved, you will see your credit limit on the screen immediately. They will send your card to your residential address through mail within 2 days.

However, you can apply through mail. You just fill the acceptance form that came along with the mail you got. Send it back and wait for about 7 working days to get details about your approval. This process is slow though.

Features and Benefits of the Citi Diamond Preferred Credit Card

- New customers get 0% introductory APR on balance transfers within the first 21 months. This will save a lot of money for customers who want to transfer a high-interest debt from another card to this card.

- There is a 0% introductory APR for the first 12 months on purchases.

- After 1 year, the purchase APR is between 14 and 24% depending on your creditworthiness.

- No annual fee.

- Free access to FICO score.

- Extra perks like access to pre-sale tickets and purchase protection.

- Travel insurance

- Rental car insurance.

- 24/7 customer service.

- Apple Pay for quick and easy payments. With a simple touch, you can pay in-app at over 200,000 stores with iPhone 6, iPad Air 2, and iPad mini 3.

from WordPress https://ift.tt/2IOFnqM

No comments:

Post a Comment