What is Credit?

Credit is Borrowing money or the ability to access goods or services with the excuse that you’ll make payment later.

Lenders, merchants, and service providers, which are known as creditors, grant credit based on their confidence that you can be trusted to pay back what you are Borrowing, along with any finance charges which may apply.

When you are seen as worthy by lenders, then you are said to be “creditworthy”, or to have “good credit”.

How Does Credit Work?

In Borrowing you money, creditors make use of a more open approach. In the United States, creditors look at your credit history (your record of borrowing and repaying funds) as a first step to know whether or not to extend credit to you.

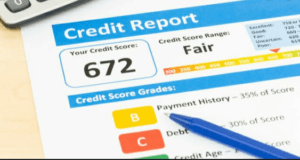

Your credit history is sumed up in files called credit reports, which is kept by three credit bureaus – Experian, TransUnion, and Equifax. Banks, credit unions, credit card issuers, and other creditors report your borrowing and repayment details of the credit bureaus.

The details contained in your credit report includes:

- The number of credit card accounts you have, their borrowing limits as well as current amount to be paid.

- The amounts of any loans that you have taken out as well as how much of them you have paid back.

- If you made monthly on-time payments for your accounts, late or missed altogether.

- More severe financial setbacks like mortgage foreclosures, buying a car, and debt.

In order to bring down their lending option, creditors often use a three-digit number called credit score as the first step to know if they will extend credit to you. Your credit score shows your details on your credit reports to something that can be easily seen and does so in a fair way that minimizes the biasness.

Systems called scoring models calculate your credit score from the contents of your credit file. Other models like the FICO® Score® and VantageScore®, calculate scores differently, but all assign higher scores to individuals whose credit makes them more creditworthy than others with lower credit scores.

Types of Credit

Credit is seen in four areas:

Revolving Credit

Revolving credit, which includes credit cards, can be used for any purchase. The term “revolving” depicts that the line of credit stays open and can be used up to the maximum limit, as long as the borrower keeps paying the least monthly payment on time.

Note that it may be paid off in full as the consumer pays the least amount and allows the other debt to pile up in interest from month to month. Revolving credit is available at a high-interest.

Charge Cards

Charge cards are cards that are issued by retailers for use only in their malls. Currently, charge cards are relatively rare. Charge cards are used just the way credit cards are used, even though they do not permit you to carry a balance. With a charge card, you are required to pay all the charges in full every month.

Service Credit

Service credit is credit agreements you have with your service providers. Like gas and electric utilities, cable and internet providers, cellular phone companies, and gyms. These companies offer their services to you each month. With the understanding that you will pay them later. Modern credit scoring systems, including the most recent versions of the FICO® Score and VantageScore. These can factor your service payment history into your credit scores. Although those payments are not always reported to the credit bureaus.

Installment Credit

Installment credit is used for a specific purpose which is issued at a defined amount for a set period of time. Payments are usually made monthly in equal installments, which are used for big-ticket purchases like major appliances, cars, and furniture. Installment credit mostly offers lower interest rates as compared to revolving credit as an incentive to the consumer. The item bought serves as collateral in case the consumer defaults.

Why is Credit Necessary

Having good credit is very good if you plan to borrow money for major items like a car or a home. You also need good credit if you like ease and purchase-protection that a credit card can provide.

With a higher credit score, you can have better interest rates and terms on loans and credit cards. Most credit card issuers also reserve their best rewards cards for customers with great credit.

Now lenders are not the only ones who check your credit reports and credit scores:

- Utility companies may also check your credit before allowing you to open an account or borrow items.

- Your credit report can also be used to verify your identity. As well as for other uses as defined by the federal law.

- Employers can also use the details found in credit reports in making a hiring chioce.

- Landlords may check your credit to decide if they’ll rent you a room. Or to know how large a security deposit to ask.

- Insurance companies can use your credit scores as factors to know your rate.

from WordPress https://ift.tt/2FmmGsZ

No comments:

Post a Comment